Purpose of the UAE VAT Clarification on Concerned Services

This Public Clarification, issued by the UAE Federal Tax Authority (FTA), provides clarification on the VAT treatment of Concerned Services. It clarifies the circumstances under which VAT must be accounted for, the requirement for issuing tax invoices, and the documentation needed to recover input tax.

1. What are Concerned Services?

Concerned Services are services received by a VAT-registered business in the UAE from a supplier outside the UAE, where the place of supply is considered to be within the UAE. These services are subject to VAT unless they would have been exempt if provided within UAE.

Example

A Dubai company hires a UK-based consultant. The UAE company must treat this as imports of services.

2. VAT Treatment – Reverse Charge Mechanism

When a UAE-registered person imports Concerned Services, the law treats this as imports of services.

Therefore, the recipient is required to:

- Account for the output VAT using the reverse charge mechanism;

- Report this VAT in Box 3 of the VAT return for the relevant tax period.

Example

If a UAE company pays AED 10,000 to a foreign service provider, it must account for 5% VAT (AED 500) under RCM on its VAT return in Box 3 and Box 10.

3. Requirement to Issue Tax Invoices

Generally, a tax invoice must be issued within 14 days of the date of supply. Since the recipient is treated as both the supplier and recipient, they are required to issue a tax invoice to themselves.

However, the FTA allows an exception to this requirement in the following case:

- If the recipient retains the original invoice issued by the foreign supplier, which contains sufficient details (e.g., service description, amount paid etc), than recipient is not required to issue an additional tax invoice to themselves.

In exceptional cases where the supplier does not issue an invoice (e.g., in reinsurance), the recipient must keep alternative documentation that includes key details like:

- Name and address of the supplier and recipient

- Date of supply and service completion

- Description of the service

- Consideration including relevant currency and payment terms

If no proper invoice or acceptable documentation is available, the recipient may apply to the FTA for an administrative exception.

Example

if UAE entity receives an invoice from a US software provider showing date, service details, and amount. Then UAE entity doesn’t need to issue the TAX invoice.

4. Input Tax Recovery

A VAT-registered recipient may recover the VAT paid (input tax) under the reverse charge mechanism if the Concerned Services are used to make taxable supplies.

To recover input tax:

- The recipient must have valid supporting documentation (e.g., a supplier’s invoice);

- The recipient must have paid or intend to pay the consideration within six months of the agreed due date.

Input tax can be recovered in the tax period in which:

- The tax invoice or supporting document is received and retained; and

- The consideration has been paid (or is intended to be paid within the allowed timeframe).

Notes:

- This clarification reflects the FTA’s interpretation of Federal Decree-Law No. 8 of 2017 and Cabinet Decision No. 52 of 2017 and its amendments.

- VATP044 constitutes an official clarification of the law.

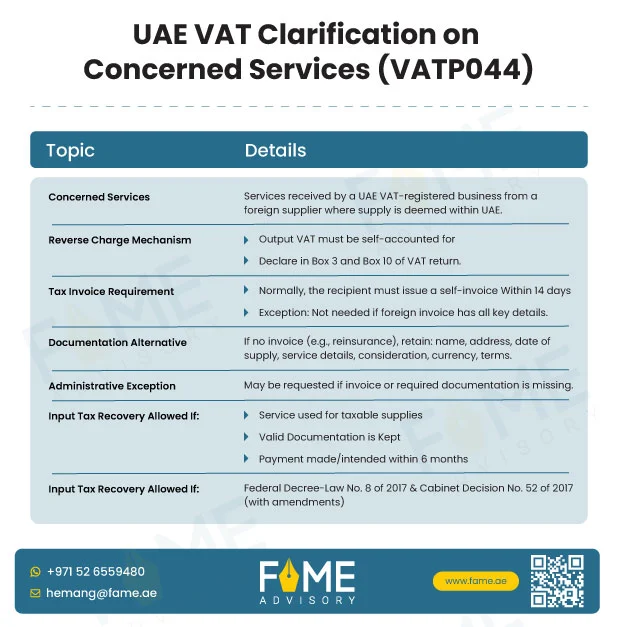

UAE VAT Clarification on Concerned Services (VATP044): In Summary

Issued: 27 May 2025 by UAE Federal Tax Authority

Topic | Details |

|---|---|

Concerned Services | Services received by a UAE VAT-registered business from a foreign supplier where supply is deemed within UAE. |

Reverse Charge Mechanism | Output VAT must be self-accounted for

– Declare in Box 3 and Box 10 of VAT return

|

Tax Invoice Requirement | -Normally, the recipient must issue a self-invoice within 14 days

– Exception: Not needed if foreign invoice has all key details.

|

Documentation Alternative | If no invoice (e.g., reinsurance), retain: name, address, date of supply, service details, consideration, currency, terms. |

Administrative Exception | May be requested if invoice or required documentation is missing. |

Input Tax Recovery allowed if: | -Service used for taxable supplies

-Valid Documentation is Kept

– Payment made/intended within 6 months

|

Relevant Laws | Federal Decree-Law No. 8 of 2017 & Cabinet Decision No. 52 of 2017 (with amendments) |