FTA Guide on Insurance and Related Services

The Federal Tax Authority (FTA) has issued a VAT Guide (VATGIN1) which outline the VAT treatment of various Insurance Services, the eligibility to recover input VAT on certain expenses and the apportionment of costs used for both taxable and exempt services.

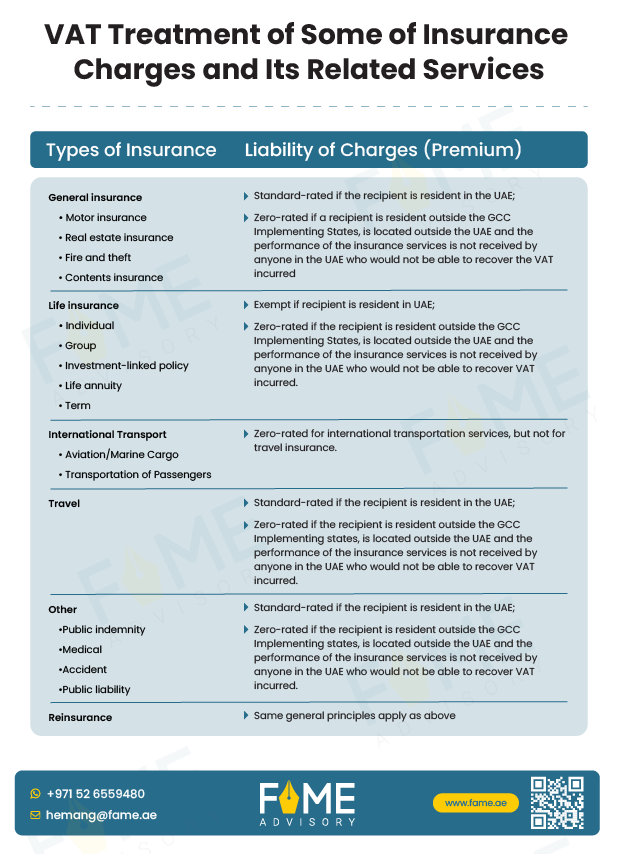

VAT Treatment of Some of the Insurance charges and its Related Services

Multiple Supplies vs. Single Composite Supplies

In cases where insurance products offered in “package” or “bundle”, the taxability of each type of service must be taken into consideration.

Multiple supplies

Where multiple and distinct services are provided and the cost of each can be separately identified (even if charged as a single inclusive price) it is treated as multiple supplies. If the components have different VAT rates, the value of each must be determined separately to calculate the total VAT due.

Example

The insurer provides theft insurance and life insurance; each charged with separate premiums on a single invoice. The life insurance premium is exempt from VAT, while the theft insurance premium is subject to a 5% VAT.

Single composite supplies

A single composite supply occurs when one element is the principal component and the others are ancillary, forming a single, inseparable supply. It is subject to VAT at a single rate applied to the total value of the supply, typically when: a) the price of the components is not separately identified or charged, and b) all components are provided by a single supplier.

Example

An insurer may offer life insurance that includes an element of health insurance to enhance the product’s appeal. Since the prices are not separately identified, the premium would be exempt, as the principal component is the life insurance, not the health insurance.

Insurance Intermediaries (Agents)

Where an insurance intermediary (i.e. an agent or broker) acts as disclosed agent for a taxable insurance transaction, the following supplies generally occur:

- The insurer supplies (re)insurance to the insured and charges the premium, which is subject to VAT at the applicable rate.

- The intermediary collects for the premium on behalf of the (re)insurer, which is not considered a supply for VAT purposes.

- The intermediary may charge the (re)insurer a fee or commission for the collection service which is subject to VAT at the applicable rate.

- Finally, the intermediary remits the premium to the insurer, which is not considered a supply for VAT purposes.

Where the intermediary acts in its own name (undisclosed agent), the above sequence becomes a series of supplies liable to VAT.

Real Estate Insurance

It is stated that insurance related to real estate is not considered a “service related to real estate” for the purpose of determining the place of supply.

According to the general rule, the place of supply for services is where the supplier is resident. However, for services related to real estate, the place of supply is determined by the location of the real estate itself, which is an exception to the general rule.

The place of supply for insurance related to real estate follows the general place of supply rules. However, when the insurance is part of a single composite supply, where the principal element is a service related to real estate and the insurance is ancillary, the place of supply for the insurance is determined by the location of the real estate.

Employee health insurance

The Federal Tax Authority (FTA) has introduced an amendment to the Executive Regulations of the UAE VAT Law through Cabinet Decision No. 100 of 2024, which amends Cabinet Decision No. 52 of 2017. According to the amended Article 53, from 15th November 2024 when an employer provides health insurance to its employees and their family members—limited to a spouse (either a husband or one wife) and up to three children under the age of eighteen—the input tax on such expenses can be recovered.

Islamic Insurance products

Any supply made under an Islamic financial arrangement, which is certified as Shariah compliant, shall be treated similarly for VAT as traditional financial products.

This is to ensure the “equality” of VAT treatment between Islamic and non-Islamic finance products.

Example

Family takaful is a type of insurance that combines long-term savings with protection for the participant and their family, usually in cases like death, disability, or survival. Normally, family takaful and family retakaful products don’t have to pay VAT because their similar non-Islamic life insurance products are also exempt.

However, if the savings part involves investing in a fund and the provider charges a separate fee for managing this fund, then that fee would be taxable under VAT rules.

Input tax apportionment for insurance providers

The standard input VAT apportionment rules apply to insurance providers:

- VAT incurred on costs wholly attributable to the standard rated and zero-rated supplies can be recovered in full.

- VAT on costs incurred wholly attributable to exempt supplies cannot be recovered at all.

- When VAT incurred is partly attributable to taxable supplies and partly to exempt supplies, the VAT is considered residual and must be apportioned. The standard method for attributing residual input tax is based on the recovery ratio percentage, which is calculated as follows:

(Input tax directly attributable to taxable supplies) ÷ (Input tax directly attributable to taxable supplies + Input tax that cannot be recovered)

If the standard apportionment method is not considered fair and reasonable, an insurance provider may apply to use a special method, subject to FTA approval. This method can only be applied from the second tax year of registration.

Insurance companies – recovery of claims costs

Where an insurer makes a payment in respect of the provision of some goods or services under the contract of insurance – e.g. for a replacement product or a repair of an asset – the question arises who may recover the VAT incurred.

The following principles should be applied in respect of determining which party may recover the VAT incurred:

- If the insurer provides a payment to the insured which is in the nature of compensation for costs incurred by the insured (e.g. in repairing a car), the input tax in respect of the costs will be recoverable by the insured (subject to the normal recovery rules).

- If the insurer incurs the cost of acquiring goods or services itself, then the input tax in respect of the costs will be recoverable by the insurer