Navigating Estate Succession in the UAE: Options for Non-Muslim Expatriates

Ayushi Agrawal

The concept of Wills is fairly common in most countries around the world. Wills offer individuals a legitimate way to have their estate distributed after their demise. It is very important to note that a Will does not have an effect until the testator dies and can be modified at any point of time during the life of the testator. It is also pertinent to note that the distribution of the estate may be handled by an executor of your choice under Wills as opposed to leaving the same in the hands of an authority of the State.

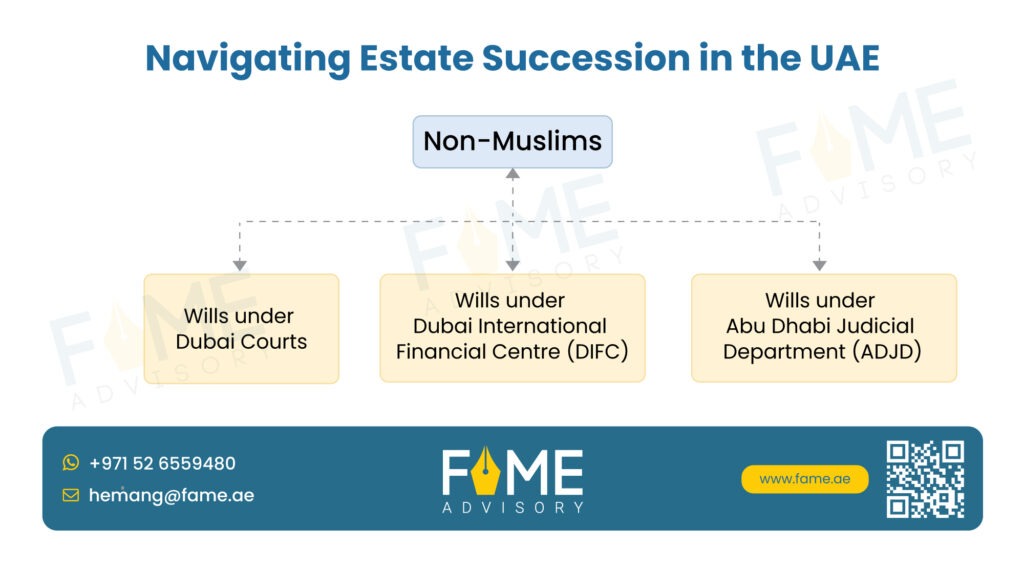

Non-Muslim expatriates in UAE may find the available platforms for their Will registration particularly handy owing to the fact that the absence of a Will leaves the distribution of their estate to be done under Shariah law, which may not be their preferred means of distribution. Wills registered with various authorities in UAE provide the much-needed flexibility to non-Muslim expatriates to choose how exactly their estate will be distributed.

We will be exploring the distribution of the estate after the demise of a non-Muslim expatriate in UAE. In this article, we will be delving into the avenues available to non-Muslim expatriates to legitimately plan their estate succession in the UAE for after their demise.

Different Avenues of Wills' Registration

1. DUBAI COURTS

Non-Muslim expatriates may register their Wills with the Dubai Courts Notary if they wish their Will to be governed under the Civil Law Jurisdiction of Dubai. The Will shall be drafted in the Arabic language by a sworn translator. The Will ensures that Shariah law is not applicable and the testator has the right to distribute their assets in any manner they wish. Estate to be distributed can be anywhere across the seven Emirates in the UAE. It is pertinent to note that Dubai Courts Notary Will also provides for guardianship of minor children in the event of the demise of either one or both parents/caregiver(s).

2. DIFC WILLS

The DIFC Wills and Probate Registry operates under a unique system, granting individuals the autonomy to choose the governing law for their Will. This flexibility allows for the application of either their home country’s legal code or the legal code of another preferred jurisdiction.

The DIFC Courts Wills Service offers five distinct Will categories:

Full Will: This comprehensive Will encompasses the distribution of all movable and immovable property within the UAE, along with the designation of temporary and permanent guardians for minor children residing in Dubai or Ras Al Khaimah (if applicable).

- Guardianship Will: Focused solely on child custody, this Will specifies guardians for minor children.

- Property Will: This online template Will facilitates the distribution of up to five real estate properties situated within the UAE.

- Business Owners Will: Another online template Will; this document addresses the distribution of up to five shareholdings in UAE-based companies.

- Financial Assets Will: Limited to online templates, this Will allows for the designation of beneficiaries for up to ten bank and/or brokerage accounts held at UAE branches.

3. ADJD WILLS

Similar to the approach followed by Dubai Courts, the Abu Dhabi Judicial Department (“ADJD”) allows non-Muslim expatriates to register their Will within the Civil Law jurisdiction of Abu Dhabi. ADJD ensures that UAE Shariah shall not be applicable to individuals who register their Wills with them and state their needs. The assets in the Will can be from any of the seven (7) Emirates in UAE. The Will must be drafted in the Arabic language or translated by a sworn translator for the same to fall within the purview of the on-shore courts of Abu Dhabi.

One notable modus operandi followed in ADJD is that the testator need not be physically present for the registration of their Wills. The same can be done by utilising virtual platforms.

Dubai Courts Will Vs DIFC Will Vs ADJD Will: Difference Matrix

While the three jurisdictions for Wills’ registration have their own advantages and disadvantages, please find below some of the key differences we have observed to be material when selecting a jurisdiction for estate succession:

Sr. No. | Scope | Dubai Courts | DIFC | ADJD |

|---|---|---|---|---|

1. | Jurisdictions Covered | All seven (7) Emirates | Only Dubai and Ras Al Khaimah | All seven (7) Emirates |

2 | Language

| Arabic or Bilingual (Arabic translation by a sworn translator)

| English

| Arabic or Bilingual (Arabic translation by a sworn translator)

|

3 | Governing Law | Law No. (15) of 2017

Concerning

Administration of Estates and Implementation of Wills of

Non-Muslims in the Emirate of Dubai

| DIFC Wills and Probate Registry Rules | ABU DHABI LAW NO. 14/2021

On Civil Marriage and its Effects

in the Emirate of Abu Dhabi

& Regulation 8/2022 |

4 | Cost of Single Full Wills | AED 2,167 | AED 10,000 + VAT | AED 950 |

5 | Cost of Mirror Full Wills | AED 4,334 | AED 15,000 + VAT | AED 1,900 |

6 | Cost of Other Wills | N/A | Property Single Will: AED 7,500 + VAT

Property Mirror Wills: AED 10,000 + VAT

Business Owners Single Will: AED 5,000 + VAT

Business Owners Mirror Wills: AED 7,500 + VAT

Financial Assets Single Will: AED 5,000 + VAT

Financial Assets Mirror Wills: AED 7,500 + VAT

| N/A |

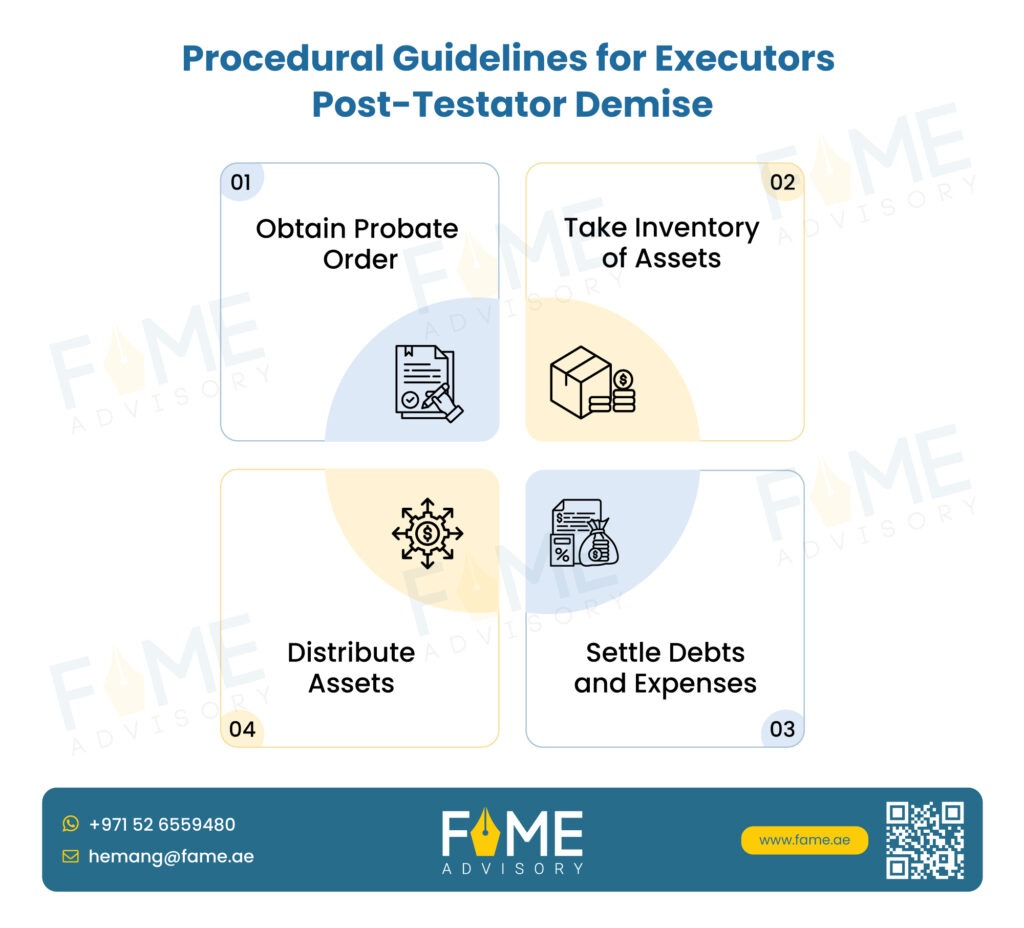

Procedural Guidelines for Executors Post-Testator Demise

The implementation and execution of the registered Will shall be handled by the Executor(s) nominated in the Will itself. It is ideal to appoint not just one Executor (primary Executor) but alternate Executor as well to provide for any and all contingencies.

The process to be followed by Executors at the time of implementation of the Will is as follows:

1. Obtain Probate

The executor will be responsible for initiating the legal process to validate your will and authorise the management of your estate. The specific procedures will depend on where your Will is registered. If it’s registered with the Notary Public, a local lawyer will be needed to handle the process. However, if it’s registered with the DIFC Courts Wills Service, the Executor can either handle it directly or through a probate specialist.

2. Take Inventory of Assets

The Executor will create a detailed list of all your assets.

3. Settle Debts and Expenses

The Executor will identify and pay all the outstanding debts and related costs on behalf of the Testator.

4. Distribute Assets

Once all debts, expenses, and specific gifts mentioned in your will are paid, your executor will divide the remaining assets among your beneficiaries as outlined in your will. The exact distribution process will vary depending on whether your will is registered with the Notary Public or the DIFC Courts Wills Service.

CONCLUSION

In conclusion, the UAE offers non-Muslim expatriates several avenues to establish their desired estate distribution post-demise. By registering a Will with Dubai Courts, DIFC Wills and Probate Registry, or ADJD, individuals can effectively bypass the application of Shariah law and exercise control over their assets.

While each jurisdiction presents distinct advantages and costs, the ability to choose the governing law and specify beneficiaries provides invaluable peace of mind. It is essential to carefully consider factors such as jurisdiction, language requirements, and associated costs when selecting the most suitable option.

By understanding the available platforms and the processes involved, non-Muslim expatriates can proactively plan for their future and ensure their wishes are honoured, providing comfort and security to both themselves and their loved ones.

FAME ADVISORY’S PROVISION OF SERVICES

We can provide you with a wide variety of services from the stage of drafting the particulars of the Will to getting the same executed.

If you would like our assistance with succession planning, please do not hesitate to contact us.

FAQs

No, the Executor need not be a UAE resident for the implementation of DIFC Wills.

The minimum age of a Testator must be 21+ years.

Search

Recent Insights

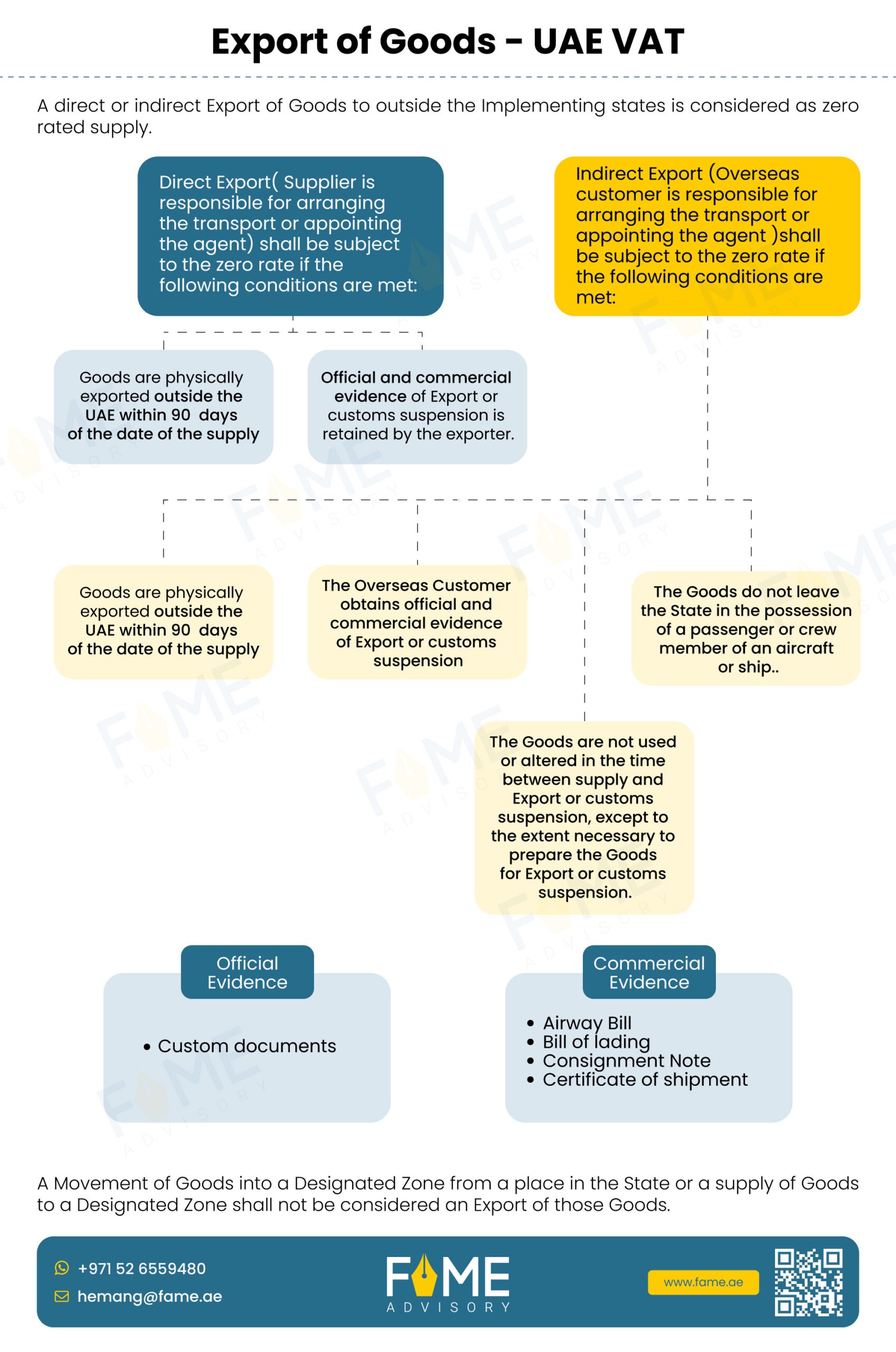

Export of Goods – UAE VAT

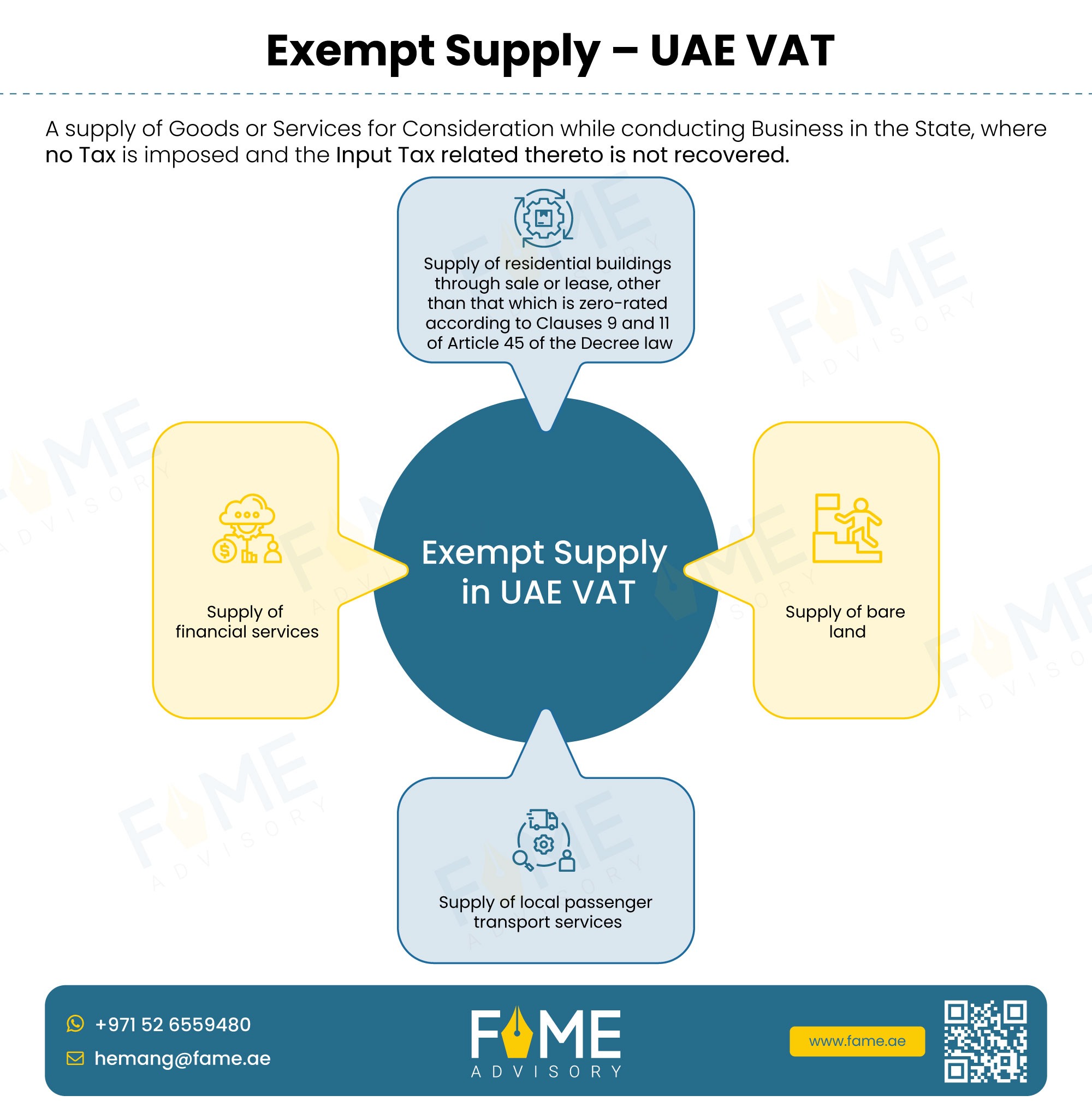

Exempt Supply – UAE VAT

Qualifying Public Benefit Entity: Registration and Exemption under UAE Corporate Tax

Ayushi Agrawal

Public benefit entities are set up for the welfare of society, focusing on activities that strengthen the UAE’s social fabric. The term “public benefit entity” refers to an organization formed by private individuals or government or non-governmental bodies for the purpose of carrying out charitable, social, cultural, religious, or other public benefit activities without the motive of making a profit for distribution to private Persons.

Each Emirate in the UAE has established a Cultural Development Authority (CDA). Non-profit organizations get themselves to register with the CDA to get the necessary approval and licenses for cultural activities. Similarly, the Chamber of Commerce issues licenses for trade and industry growth.

To qualify for corporate tax (CT) exemption, these entities shall comply with Article (9) of the Corporate Tax Law and adhere to all relevant federal and local regulations. Organizations engaged in social, cultural, religious, charitable, or other public benefit activities can apply for a corporate tax exemption. If approved, they will be listed in a cabinet decision requested by the Minister of Finance. Only public benefit entities listed by the Cabinet are eligible for the tax exemption.

What are Qualifying Public Benefit Entities?

Qualifying Public benefit entities (QPBE) are those entities which are established and operated exclusively for any of the following activities:

- Religious

- Charitable

- Scientific

- Artistic

- Cultural

- Athletic

- Educational

- Healthcare

- Environmental

- Humanitarian

- Animal Protection; or

- Other similar purposes

Conditions for Qualifying Public Benefit Entities to be Exempt from Corporate Tax

The following conditions need to be satisfied by the qualifying public benefit entities to be exempt from corporate tax:

- It shall not be engaged in a business or business activity. But it can carry on such activities that directly relate to or are undertaken for fulfilling the various public benefit purposes for which the entity is established like it should be established for any of the following purposes:

- exclusively for religious, charitable, scientific, artistic, cultural, athletic, educational, healthcare, environmental, humanitarian, animal protection or other similar purposes, or

- as a professional entity, chamber of commerce, or a similar entity operated exclusively for the promotion of social welfare or public benefit.

- The income and the assets of the entity should be exclusively used in the furtherance of the purpose for which it is established or for the payment of any associated necessary and reasonable expenditure incurred.

- No part of its income or assets should be utilised for the personal benefit of the shareholder, member, trustee, founder or settlor of the public benefit entity.

The Cabinet may prescribe further conditions for eligibility of an entity to claim exemption.

The entity shall make an application to the relevant local or federal government entity with which it is registered in the prescribed manner to claim exemption from the corporate tax.

The exemption would be available from the beginning of the tax period in which the Cabinet approves the application, or any other date determined by the Minister.

The relevant government entity will consider the application and may request evidence or ask to prove that the conditions as set forth in the Corporate Tax Law are properly satisfied. On successful verification, authority will refer the case to the Ministry of Finance for inclusion in a memo from the Minister to the Cabinet. Following the issuing of such a decision the entity will qualify to be exempt from Corporate Tax.

The definition of Qualifying Public Benefit Entity in the Corporate Tax Law requires that in addition to meeting the conditions in Article 9 of the Corporate Tax Law, the entity must be listed in a decision issued by the Cabinet at the suggestion of the Minister.

Cabinet Decision No. 37 of 2023, issued on 7 April 2023, sets out a list of entities that are to be considered as Qualifying Public Benefit Entities for the purposes of the Corporate Tax Law. The Cabinet has the power to amend the list in the future at the suggestion of the Minister, making either additions or deletions to it.

Payments to a Qualifying Public Benefit Entity

A Taxable Person who makes donations, grants or gifts to a Qualifying Public Benefit Entity which is listed in a Cabinet Decision can claim a deduction for Corporate Tax purposes. No deduction is allowed for donations, gifts or grants made to an entity that is not a Qualifying Public Benefit Entity.

Compliance and Record Keeping

Qualifying Public Benefit Entities listed in Cabinet Decision No. 37 of 2023 must still register with the FTA for Corporate Tax purposes and obtain a Corporate Tax Registration Number (“TRN”). The application to register for Corporate Tax purposes for Qualifying Public Benefit Entities has been made available from 1 October 2023.

Qualifying Public Benefit Entities are not required to file a Tax Return. Instead, they are required to submit an annual declaration to the FTA, no later than 9 months from the end of the relevant Tax Period.

They are required to maintain records which evidence their exempt status for 7 years from the end of the Tax Period to which they relate. This includes any information, accounts, documents and records to enable the Exempt Person’s status to be readily ascertained by the FTA. For example, for a Qualifying Public Benefit Entity, this could include books and records to demonstrate that its resources were used only for its stated public benefit purpose, copies of agreements entered into, and details of its employees, officers and fiduciaries.

Implication of Breach in Conditions

Failure is of temporary nature which is promptly rectified:

If an Exempt Person breaches the conditions to be followed, they may continue to be deemed as an Exempt Person where all of the following conditions are met:

- The failure to meet conditions is due to unforeseen circumstances beyond the Exempt Person’s control, which they could not reasonably predict or prevent.

- The Exempt Person must apply to the FTA within 20 business days of failing to meet the conditions to remain exempt. The FTA will review and notify the decision within the same period or a reasonable time thereafter.

- The Exempt Person must rectify the failure within 20 business days of applying. An additional 20 business days may be granted if the rectification is beyond their reasonable control.

- Upon request by the FTA, the documentation should be provided to the FTA within 20 business days from the date of the request by the FTA, or any other period as may be determined by the FTA.

Failure to obtain Corporate Tax advantage:

The Exempt Person shall cease to be an Exempt Person starting from the day they fail to meet the conditions in case it can be reasonably concluded that the main purpose or one of the main purposes of this failure is to obtain a Corporate Tax advantage specified under the General Anti-abuse Rule that is not consistent with the intention or purpose of the Corporate Tax Law.

Seeking Professional Help for Registering Qualifying Public Benefit Entity

Following is the way how tax consultants like FAME can help qualified public benefit entities in registration under the corporate tax law and in legal compliance:

Expert Guidance on Regulatory Compliance:

Tax consultants specializing in non-profit entities understand the complex requirements set out by the Ministry of Finance and local authorities. They can ensure that your entity meets all necessary criteria for registration and exemption, and adherence to Article 9 of the Corporate Tax Law.

Streamlined Application Process:

Professionals can help prepare and submit the application to the Ministry of Finance or relevant governing bodies in the correct format and with all required documentation. This reduces the risk of delays or rejections due to incomplete submissions.

Representation on behalf of QPBE:

In case of audits or queries from tax authorities, tax consultants can serve as an authorized representative for the entity and can play the role of an important bridge between the entities and authority.

Conclusion

Qualifying Public benefit entities in the UAE serve a crucial role in enhancing societal well-being through activities that include charitable, cultural, and humanitarian domains. Known by their non-profit nature and commitment to public service, these organizations seek exemption from corporate tax under stringent criteria as defined in Article 9 of the Corporate Tax Law. To qualify, such entities shall have to apply to the authority and get approval according to the guidelines provided in the law. To qualify for an exemption such entities shall satisfy certain conditions like they shall not be engaged in a business or business activity and shall exclusively carry on the religious, charitable, scientific, artistic, cultural, athletic and educational kind of activities. The income and the assets of the entity should be exclusively used in the furtherance of the purpose for which it is established etc.

While a Qualifying Public Benefit Entity may qualify for exemption from corporate tax, but it would still be required to maintain financial records and follow prescribed guidelines and compliance requirements.

Get in touch with us to establish a Qualifying Public Benefit Entity in UAE and claim various tax exemptions available under the UAE corporate tax laws.

Search

Recent Insights

Navigating the Legal Landscape of DIFC Foundation Wealth Distribution

Ayushi Agrawal

The concept of a Foundation finds its roots within civil law jurisdictions, offering a familiar legal framework for countries within the GCC region that share a similar heritage. Unlike a trust, a Foundation operates as an independent legal entity, distinct from its Founder. This distinction safeguards the Founder’s personal assets, ensuring the Foundation’s holdings remain separate. We offer services for forming a Foundation in Dubai International Financial Centre (DIFC).

This article will delve into the nuances of wealth distribution from the perspective of Foundations.

What is a DIFC Foundation?

Similar to a company, a Foundation possesses its own legal personality, allowing it to enter into contracts and hold property. However, a key distinction lies in its purpose. A Foundation is not driven by shareholder interests or profit generation. It lacks the ability to issue shares or engage in commercial activities beyond those directly supporting its stated objectives.

The core of a Foundation revolves around its objects, which define its purpose(s) and may identify specific Beneficiaries. These objects, along with the Founder’s wishes, are enshrined in the Foundation’s Charter and By-laws, serving as the Foundation’s guiding constitution. Management is entrusted to a Council, mirroring the structure of a company board with its Council Members. Such foundations governed by the DIFC Foundations Law of 2018 are referred as DIFC foundations.

Foundations offer a versatile tool for a variety of applications:

Family Wealth/Succession Planning:

Foundations provide a structured framework for wealth transfer across generations, ensuring the continued fulfilment of the Founder’s wishes.

Asset Protection:

By separating assets from the Founder’s personal wealth, Foundations offer a layer of protection in case of unforeseen circumstances.

Commercial Transactions:

Foundations can be employed to facilitate complex commercial transactions.

Securitization Structures:

Foundations can act as vehicles for securitization, a financial structuring technique.

Long-Term Business Holding:

Foundations possess the ability to hold assets and businesses for extended periods.

Anti-Hostile Takeover Instruments:

Foundations can be strategically utilized to deter unwanted corporate acquisitions.

Charitable Purposes:

A cornerstone application, Foundations serve as a conduit for philanthropic endeavours.

Letter of Wishes: Non-Binding Expressions of Intent

While Wills hold legal weight, Letters of Wishes serve a distinct purpose. These documents express the testator’s wishes and preferences regarding estate distribution beyond the legally binding directives outlined in the Will. Letters of Wishes provide valuable guidance to executors and/or trustees in managing the estate, potentially including suggestions for charitable donations or preferred asset allocation among beneficiaries. Unlike Wills, Letters of Wishes are not legally enforceable. However, their flexibility is a key advantage, allowing for modification or revocation at any time without the formalities and costs associated with amending a Will.

In conclusion, navigating estate planning within the DIFC requires an understanding of the distinct legal frameworks governing Foundations. This knowledge empowers individuals to make informed decisions regarding the distribution of their assets and the expression of their wishes for the future management of their estate.

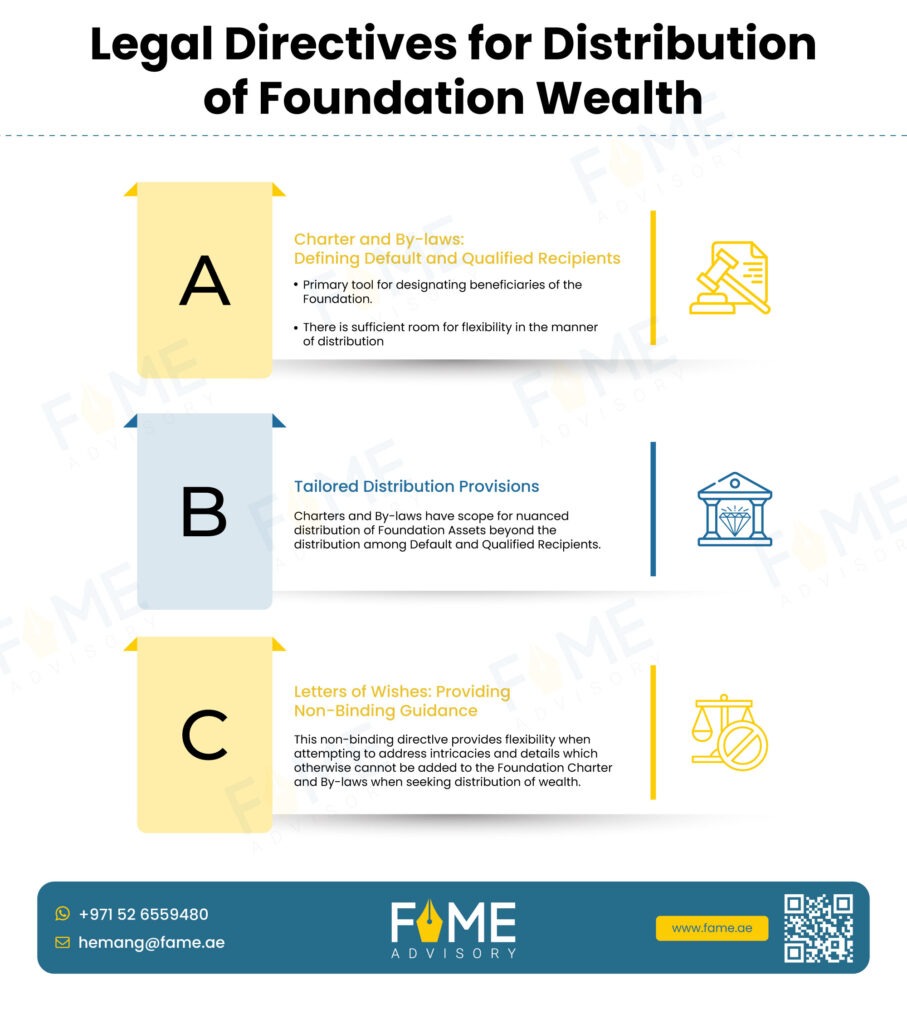

Legal Directives for DIFC Foundation Wealth Distribution

The effective distribution of a Foundation’s wealth upon its dissolution is a critical consideration for Founders.

Directive I: Charter and By-laws: Defining Default and Qualified Recipients

The Foundation’s Charter and By-laws serve as its primary governing documents. Within these documents, Founders can designate beneficiaries for the Foundation’s assets. Two primary categories exist:

- Default Recipient: This recipient receives any unallocated assets upon the Foundation’s termination.

- Qualified Recipient: This recipient holds a legal entitlement, as specified in the By-laws, to a predetermined share of the Foundation’s wealth upon dissolution.

Beyond these default categories, Founders have the flexibility to establish more nuanced distribution models within the Charter and By-laws. Careful legal drafting is essential to ensure compliance with the relevant Foundation law.

Directive II: Tailored Distribution Provisions

Our experience demonstrates a need for distribution models beyond the default and qualified recipient structures. Founders may wish to:

- Designate additional beneficiaries beyond the initial and qualified categories.

- Specify precise distribution ratios for various beneficiaries, ensuring a non-equal distribution.

Such specific distribution instructions can be incorporated into the Foundation’s Charter and By-laws, fostering a more customized approach to wealth allocation.

Directive III: Letters of Wishes: Providing Non-Binding Guidance

Letters of Wishes offer a complementary tool for Founders. Unlike Wills, they are non-binding documents. However, they serve a valuable purpose by expressing the Founder’s wishes for the distribution and future management of the Foundation’s wealth. Letters of Wishes can specify:

- The desired timing of asset distribution.

- The intended purpose for which the wealth should be used.

- Specific allocations of certain assets or investments to designated recipients.

This flexibility allows Founders to address intricacies and complexities beyond the scope of legally binding documents like the Charter and By-laws of the Foundation.

Case Study

On many instances, clients have approached us with concerns relating to the distribution of their Foundation Wealth both during their subsistence and after their demise. Both in tailor made ratios or in such a manner as to give certain types of wealth, i.e. investments to one heir and other fixed assets to the other heir at different circumstantial intervals.

We have trained professionals equipped to provide the best possible advice with regard to situation specific concerns.

Conclusion

The distribution of Foundation wealth requires a thoughtful approach. By strategically utilizing Charters and Letters of Wishes within the legal framework of DIFC, Founders can ensure their philanthropic or wealth distribution goals are effectively realized upon the Foundation’s dissolution.

This article summarizes all the practical aspects that we have dealt with so far, with regard to wealth management of Foundations. You can keep this as your guide to further wealth distribution plans you may have with regard to your respective Foundation(s).

FAME Advisory's provision for DIFC Foundation Wealth Distribution

We can provide you with a wide variety of services from the stage of drafting the particulars of the Foundation Charter and By-laws or Letter of Wishes to getting the same attested.

If you would like our assistance with wealth planning and Foundations, please do not hesitate to contact us.

FAQs

Letter of Wishes are not legally binding. It is recommended to create a Letter of Wishes in order to provide guidance to the Executors when following the directions contained in the Foundation By-laws when distributing the wealth.

Insertions to the Charter and By-laws and drafting of a Letter of Wishes can be made at any stage of the Foundation’s subsistence.

Search

Recent Insights

Tax Loss Relief under UAE’s Corporate Tax Law: Key Factors

Ayushi Agrawal

What Is Tax Loss and Tax Loss Relief Under UAE Corporate Tax Law?

Businesses may experience losses during the initial startup phase while it is investing in growing their Business, or sometimes mature businesses may make a loss over a period because of a temporary, adverse trading environment.

UAE Corporate tax law recognizes this very well and that’s why corporate tax is calculated on a company’s overall profitability throughout its existence and not just on a single year’s income.

It is also in line with international practice across the world that allows the taxable person to offset its loss incurred in one period against the taxable income of future period.

What is Tax Loss?

A tax loss refers to a loss, as per the tax laws, that a business incurs in a particular tax period. It occurs when a Taxable Person’s deductible expenses under the tax law exceed its income in a particular financial period.

What is Tax Loss Relief?

As per Article 37, Tax loss relief in the UAE’s corporate tax law allows businesses to offset losses from one tax period against taxable income in subsequent tax periods to arrive at the taxable income for that subsequent tax period.

Circumstances of Non-availability of Tax Loss Relief Under UAE Corporate Tax Law

Under the following circumstances, tax loss relief is not available:

- Losses incurred before the date of commencement of UAE Corporate Tax Law

- Losses incurred by a Person before becoming a Taxable Person under the UAE Corporate Tax Law.

- Losses incurred from an asset or activity, the income of which is exempt under the UAE Corporate Tax Law.

Limitations for Tax Loss Relief Under UAE Corporate Tax Law

Tax Loss Relief Maximum Amount:

A Taxable Person can carry forward Tax Losses and offset them against Taxable Income in subsequent Tax Periods, subject to meeting certain conditions.

The amount of tax loss that is allowed to offset against the taxable income of that subsequent period cannot exceed 75% of the taxable income of that subsequent period before claiming any tax loss relief against the taxable income.

Tax Loss Relief Maximum Period:

The CT law does not provide any restriction on the number of years for which the tax relief would be set off. Accordingly, the tax loss can be carried forward for an indefinite period.

This implies that every profit-making business would be liable to pay tax on the remaining twenty-five per cent of the income after adjustment of losses or full profit if there are no previous losses, while loss-making businesses will carry forward their losses for an unlimited time.

Can Tax Loss Relief Under UAE Corporate Tax Law be Carried Forward for an Indefinite Period?

According to Article 37 of the UAE CT Law, the tax losses can be carried forwarded to subsequent tax period for set off.

However, Article 39 imposes certain restrictions on the carry and forward of the utilization of the Tax Loss. Tax losses can be carried forward from one Tax period to a subsequent tax period only if the following conditions are satisfied:

Continuity of Ownership Requirement:

The UAE CT Law discourages the trading of loss. Acquisition of an entity just for the purpose of utilization of its tax loss is not permissible under the Act.

The CT law allows carry forward and set off of loss only if the same person or persons continues to hold at least 50% ownership interest in the taxable person throughout from the beginning of the tax period in which the tax loss is incurred to the end of the tax period in which the tax loss or part thereof is offset against taxable income.

For example, Company ABC and Company DEF are unrelated entities. Company ABC, incorporated in the UAE, incurs a tax loss of 2 million AED in its tax period. Company DEF approaches Company ABC with the intention of acquiring it solely for the purpose of utilising Company ABC’s tax loss.

- In the above situation, Company DEF’s acquisition of Company ABC solely for the purpose of utilizing its tax loss would not be permissible under the UAE CT Law.

Continuity of Business Requirements:

In case of a change in ownership interest, the taxable person shall be allowed to carry forward and set off the losses only if the taxable person continues to conduct the same or similar business or business activity in which the loss was incurred. The following factors would be relevant to determine the continuity of the same or similar business or business activity.

- The taxable person utilises some or all the assets as before the change in ownership

- The taxable person has not made any significant changes to the core operations or identity of the business

The loss can be allowed to be carried forward and set off in case of change in the core identity or operations of the business, if the changes are resulting from of the exploitation or development of services, assets, resources etc. that existed before the change in ownership.

Special Conditions for Listed Companies:

The limitation on tax losses carried forward as per Article 39 will not apply where the shares of the Taxable Person are listed on the Recognised Stock Exchange.

Transfer of Tax Loss between the Taxable Persons

As per Article 38 of the UAE CT Law, The Tax Loss may be transferred between the two Taxable persons where all of the following conditions are satisfied:

1. Both the taxable persons, transferor and transferee, should be juridical persons

Transferor | Transferee | Is transfer allowed? |

|---|---|---|

Company | Company | Yes |

Company | Shareholder

| No

|

Shareholder | Company | No

|

Mother | Son | No |

2. Both the taxable persons should be tax residents of the UAE.

Transferor | Transferee | Is transfer allowed? |

|---|---|---|

Resident | Resident | Yes |

Resident | Non-Resident | No

|

Non-Resident | Non-Resident | No

|

Non-Resident | Resident | No |

3. Common Ownership Interest:

The taxable person should have an ownership interest of at least 75% in another taxable person directly or indirectly. Thus, a subsidiary can also transfer the tax loss to a parent company or vice versa, subject to the fulfilment of 75% ownership criteria. Further, the transfer of loss is allowed to a sister concern, commonly controlled by a third person directly or indirectly.

For example, X Ltd., an Indian company, holds 80% of two UAE-based companies, Y Ltd. and Z Ltd. Y Ltd. and Z Ltd. can transfer the tax loss internally as both the companies are controlled by a common ownership interest to the extent of 75% or more by a common company X Ltd.

4. Continuous Ownership Interest:

The ‘common ownership’ of 75% in both taxable persons should exist from the start of the tax period in which the tax loss is incurred to the end of the tax period in which the loss is transferred.

5. Both Taxable Persons are not Exempt Persons

- Both Taxable Persons are not Qualifying Free Zone Persons

- Both the Taxable person’s financial year should end on the same date

- Both Taxable Persons prepare their Financial Statements using the same accounting standards

Case Study

Here is the case study which calculates the maximum amount of loss which can be transferred and utilised as per the facts provided:

AXE Ltd. holds 77% shares of WYE Ltd.

- In tax period 1, AXE Ltd. suffered a tax loss of 200,000 AED.

- In tax period 2, AXE Ltd. generated a taxable income of AED 60,000.

- In tax period 2, WYE Ltd. earned a taxable income of AED 75,000.

Tax Period | AXE Ltd. Tax Loss | AXE Ltd. Taxable Income | Loss Set-off | WYE Ltd. Taxable Income | Max. loss transferrable to WYE Ltd. | Loss Carried Forward |

|---|---|---|---|---|---|---|

1. | 200,000 | – | – | – | – | 200,000 |

2. | – | 60,000

| 45,000

(60,000 X 75%)

| 75,000

| 56,250

(75,000 X 75%)

| 98,750

(200,000-45,000-56,250) |

In the above scenario, AXE Ltd. has brought forward a loss of AED 200,000 in tax period 1, which shall be carried forward to tax period 2. As per Article 37(4), the brought forward loss shall be utilised first against the taxable income of AXE Ltd. Accordingly, the maximum loss which can be offset against the taxable income of tax period 2 is 45,000 AED (75% of 60,000 AED).

Since AXE Ltd. owns more than 75% of shares of WYE Ltd., a resident taxable person, the tax loss of AXE Ltd. can be transferred and utilised to offset the taxable income of WYE Ltd. However, the quantum of loss cannot be more than 75% of the taxable income of WYE Ltd. Hence, AXE Ltd. can transfer a tax loss of up to 56,250 AED. (75% of 75,000 AED).

The remaining tax loss of 98,750 AED (200,000 AED – 45,000 AED – 56,250 AED) can be carried forward by AXE Ltd. to the tax period 3.

Seeking Professional Help to Manage Your Tax Loss Relief

The UAE Corporate Tax Law provides various tax loss relief provisions that can be strategically utilised to minimize a company’s tax burden. However, understanding these regulations can be complex, especially for businesses which are unfamiliar with UAE tax law.

However, a tax consultant can help in the following manner:

Maximizing Tax Loss Relief:

A consultant can make sure that the business claims all eligible tax losses and understands the rules of carry-forward of losses and their limitations.

Compliance with Ownership and Business Continuity Rules:

Tax consultants can advise on maintaining the required ownership structure and business continuity to qualify for tax loss relief.

Optimizing Loss Transfer Between Group Companies:

Consultants can guide businesses on fulfilling the conditions for transferring tax losses between group companies under the 75% ownership rule.

Mitigating Tax Risks:

Tax Consultants can help in identifying potential issues and ensure that tax loss claims made by the company is as per the UAE Corporate tax law’s regulations and provisions.

Conclusion

Tax loss relief provisions under Articles 37, 38, and 39 of the UAE Corporate Tax Law serve as vital tools for businesses to manage their tax liabilities effectively. By allowing the offsetting of losses against future taxable income, UAE CT Law promotes investment, entrepreneurship, and economic growth.

However, it’s crucial to understand the conditions and limitations drafted in these provisions. The requirement for continuity of ownership and business activities ensures that tax relief is granted within a legitimate business context, and it strongly prevents the abuse of this mechanism to gain any kind of false advantage by way of availing of the wrong tax loss relief.

Also, the ability to transfer tax losses between related entities under certain conditions helps the business in strategic tax planning within the corporate groups.

Compliance with these regulations demands a deep understanding of UAE tax law and due to such complexities taking professional assistance from tax consultants is very much required. FAME being a leading Tax consultant in UAE, offers expertise in maximizing tax loss relief, ensuring compliance with ownership and business continuity rules, optimizing loss transfers between group companies, and also mitigating tax risks.

Search

Recent Insights

GCC Tax And Regulatory Communique July 2024

UAE Corporate Tax Group: Pros, Cons, and Considerations

Ayushi Agrawal

In the UAE Corporate Tax Law, a tax group refers to a special arrangement where two or more resident companies can come together to operate as a single taxable entity, subject to the conditions of Article 40 of the Corporate Tax Law.

This means If the companies meet the requirements to form a UAE Corporate Tax Group, and their application to form such Tax Group is approved by the Federal Tax Authority, they can file a single UAE CT return covering all the members of the Tax Group.

Who Can Form a UAE Corporate Tax Group?

What Conditions Need to be Fulfilled to Form a UAE Corporate Tax Group?

The following conditions need to be fulfilled to form a UAE Corporate Tax Group:

Juridical persons

Tax Residents

Parent Company | Subsidiary | Allowed? |

|---|---|---|

Resident | Resident | Yes |

Resident | Non- Resident

| No

|

Non- Resident | Non- Resident | No

|

Non- Resident | Resident | No |

1. The parent company should own at least 95% of the ownership interest

- Share capital

- Voting rights

- Entitlement to profits and net assets

2. None of the company is an Exempt Person:

- Exempt persons include public charities, government entities, and certain specialized activities.

- QFZPs are companies operating in designated free zones with their own tax regimes

3. Shared Financial Year and Standards:

Pros of Forming a UAE Corporate Tax Group

Single filing required

- The tax group is required to file only one consolidated tax return under UAE Corporate Tax Law.

- This will significantly simplify the tax compliance compared to filing of individual returns for each member separately.

No applicability of Arm’s length principles and Transfer Pricing Documentation

Losses of one company set off in the same year with another company leading to cash benefits

Lower compliance burden due to single Corporate Tax return

Cons of Forming a UAE Corporate Tax Group

Single exemption limit irrespective of tax group members

- Under the UAE Corporate Tax Laws, once the tax group is formed, the threshold of AED 375,000 applies collectively to the entire tax group rather than to each member individually.

- Under the UAE Corporate Tax Laws, once the tax group is formed, the threshold of AED 375,000 applies collectively to the entire tax group rather than to each member individually.

Mandatory to prepare consolidated financial statements

- The Formation of Tax groups mandatorily requires the preparation of consolidated financial statements in accordance with applicable accounting standards.

- This will make the overall accounting process complex and lead to higher compliance costs compared to the preparation of individual financial statements.

Triggers joint as well as several liabilities

- All members of a tax group share joint and several liabilities for the entire tax group’s corporate tax liabilities. This implies that group members are collectively and individually responsible for meeting corporate tax obligations.

- So, in case any member denies making the payment of their individual share, other members can be held responsible for the payment of the entire corporate tax liability.

Potential complications on engaging in M&A activity

- Joining or leaving in the tax group may lead to complications during mergers and acquisitions (M&A) activities.

- Changes in the overall group composition can have implications on tax positions and restructuring among the group members might be required during the mergers and acquisitions.

Limited to parent-subsidiary relationships, resident, and taxable persons

- The formation of a UAE Corporate Tax Group is limited to parent-subsidiary relationships, and it applies to only entities that are residents and taxable persons.

- Due to such restrictions, certain types of business entities cannot form a Tax group to enjoy the benefits of group taxation.

Conclusion

What is tax group is one of the most frequently asked questions. A Tax Group is a specialized arrangement wherein two or more resident companies consolidate their financials and operate as a single taxable entity. Key prerequisites for tax group registration in UAE include the following: each member should be a juridical person, each participant should be a UAE tax resident and not exempt under UAE CT Law, the parent company should own at least 95% of the ownership interest, and shared financial years and accounting standards are mandated among all the subsidiaries of the Tax Group.

As an entity, a Tax Group enjoys multiple benefits, including a simplified tax group registration process, consolidated tax filing, exemption from transfer pricing documentation, and the flexibility to offset losses against profits within the group. However, Tax Groups face various challenges, including a collective exemption limit for the entire group, mandatory preparation of consolidated financial statements, joint and several liabilities for tax obligations, complexities during mergers and acquisitions, and limitations to parent-subsidiary relationships among resident and taxable entities.

Forming a UAE Corporate Tax Group can offer several advantages, but careful analysis of UAE CT treatment to group structure is crucial before deciding. An assessment of the potential benefits against the drawbacks, considering your specific group structure, financial situation, and future plans, is essential.

FAME is one of the best corporate tax consulting firms in UAE. We help businesses with tax group registration, impact assessment, and tax compliance services.

FAQs

Search

Recent Insights

Guide on Treatment of Unrealized Gains and Losses Under UAE Corporate Tax

Guide on treatment of unrealized gains and losses under UAE Corporate Tax provides you the complete knowledge on the topic. For calculating taxable income under the UAE Corporate Tax law (the CT law), general rules for determining taxable income- defined under Article 20 of the Corporate Tax Law (CT law) are to be considered.

According to Article 20 (2) of the CT law – taxable income for a tax period shall be calculated by considering accounting income and making specific adjustments defined under Article 20 (2); the first adjustment is for- any unrealised gains or losses under UAE Corporate Tax.

We first explained about the realisation principle and when the income is realised. Then, we shed light on what are the unrealised gains or losses under UAE corporate tax.

This guide also highlights how unrealised gains and losses are treated and how they impact the computation of Taxable income and how the adjustments are made. We have also included case study for better understanding. For thorough understanding of treatment of unrealised gains and losses, checkout the guide.