- April 13, 2025

On the introduction of e-Invoicing in the United Arab Emirates, Ministry of Finance (MoF), UAE has released an eInvoicing Programme Consultation Paper (Consultation Document) which outlines the main features of the proposed e Invoicing model, the framework of e Invoicing in the UAE and the expected Data Dictionary, along with specific use cases.

Our article has been published, covering the background of eInvoicing, the UAE eInvoicing framework, and an overview of the Data Dictionary (https://fame.ae/uae-ministry-of-finance-program-for-e-invoicing-in-uae/) .As a continuation, we now outline the contents of the Data Dictionary, providing explanations of the mandatory fields.

Decoding UAE’s eInvoicing Data Dictionary: Mandatory Fields You Must Know

Consultation paper of MoF elaborate “Data Dictionary” which forms the basis of eInvoicing and outlines the essential data elements (fields) and their attributes for the most commonly used invoice types by businesses in the UAE. It covers tax invoices, tax credit notes, self-billing, and other relevant scenarios. There are minimum required fields for issuing tax invoices (50 fields) and commercial invoices (49 fields) in XML format, including several that are not currently addressed by UAE VAT legislation. The Consultation Document also confirms the presence of additional conditional fields in the complete Data Dictionary, which is yet to be published.

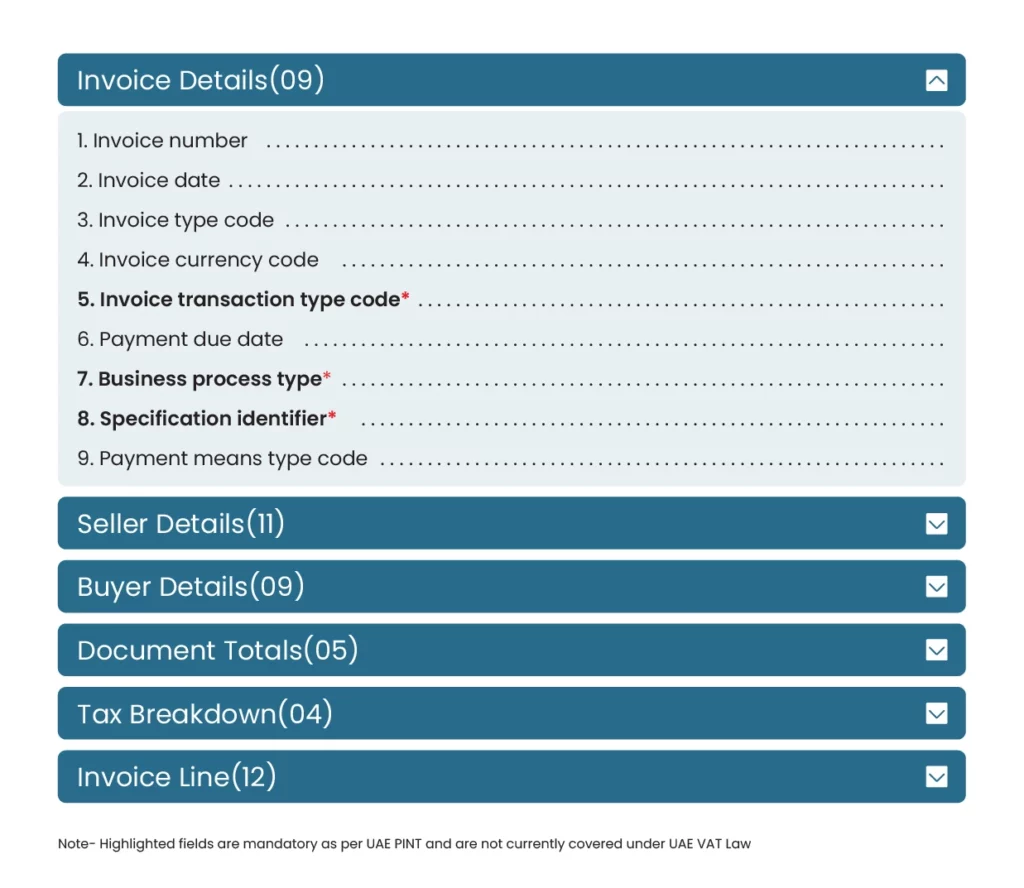

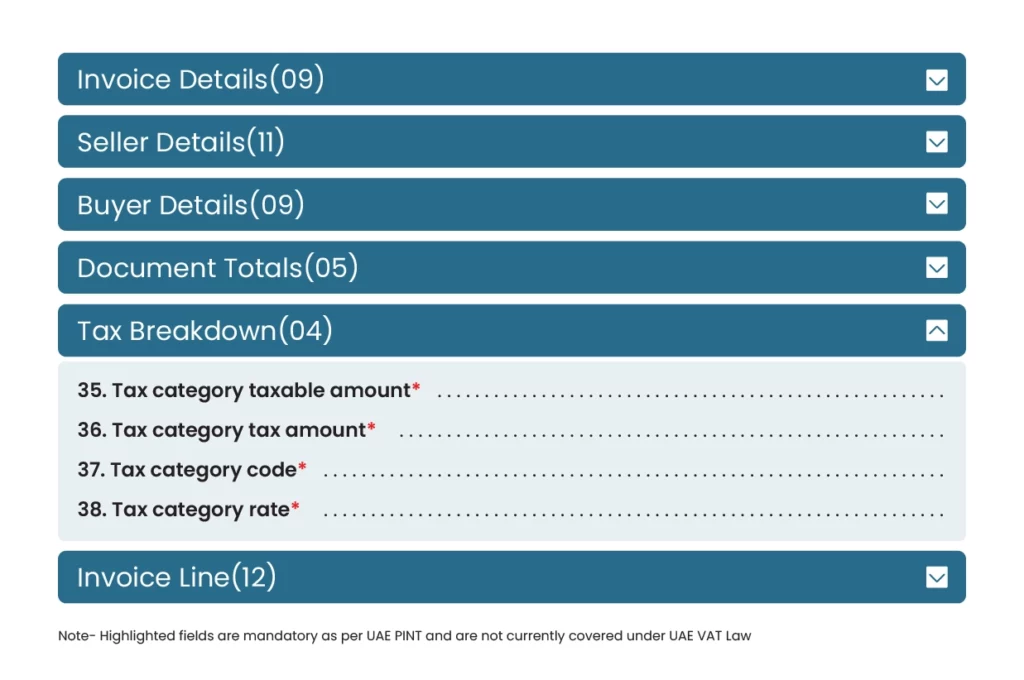

The below table lists the mandatory fields when issuing a tax invoice:

Invoice Details

1. Invoice Number (IBT-01)

A unique identifier for the invoice, mandatory for all invoices. The invoice number must be provided to ensure traceability and compliance with UAE standards.

2. Invoice Issue Date (IBT-02)

The date when the invoice was issued, formatted as YYYY-MM-DD. This is mandatory and must adhere to specific formatting rules for consistency.

3. Invoice Type Code (IBT-03)

A code specifying the functional type of the invoice (e.g., standard, credit note). It must follow the UNTDID 1001 code list.

4. Invoice Transaction Type Code (BT UAE-02)

A sequence of flags identifying the transaction type (e.g., Free Trade Zone, Deemed Supply). Each flag indicates applicability (1) or non-applicability (0).

5. Invoice Currency Code (IBT-05)

The currency in which all invoice amounts are given, except for the total tax amount in accounting currency. It must use ISO 4217 alpha-3 codes.

6. Payment Due Date (IBT-09)

The date by which payment is due. This is mandatory when the payment amount is greater than zero and must follow the YYYY-MM-DD format.

7. Business Process Type (IBT-023)

Identifies the business process context (e.g., billing) to enable proper invoice processing. It must follow the format urn:peppol:bis:billing.

8. Specification Identifier (IBT-024)

An identifier for the specification containing the rules for semantic content, cardinalities, and business rules. It must start with urn:peppol:pint:billing-1@ae-1.

9. Payment Means Type Code (IBT-081)

A code indicating how payment is expected or settled (e.g., bank transfer). Must use UNCL4461 codes.

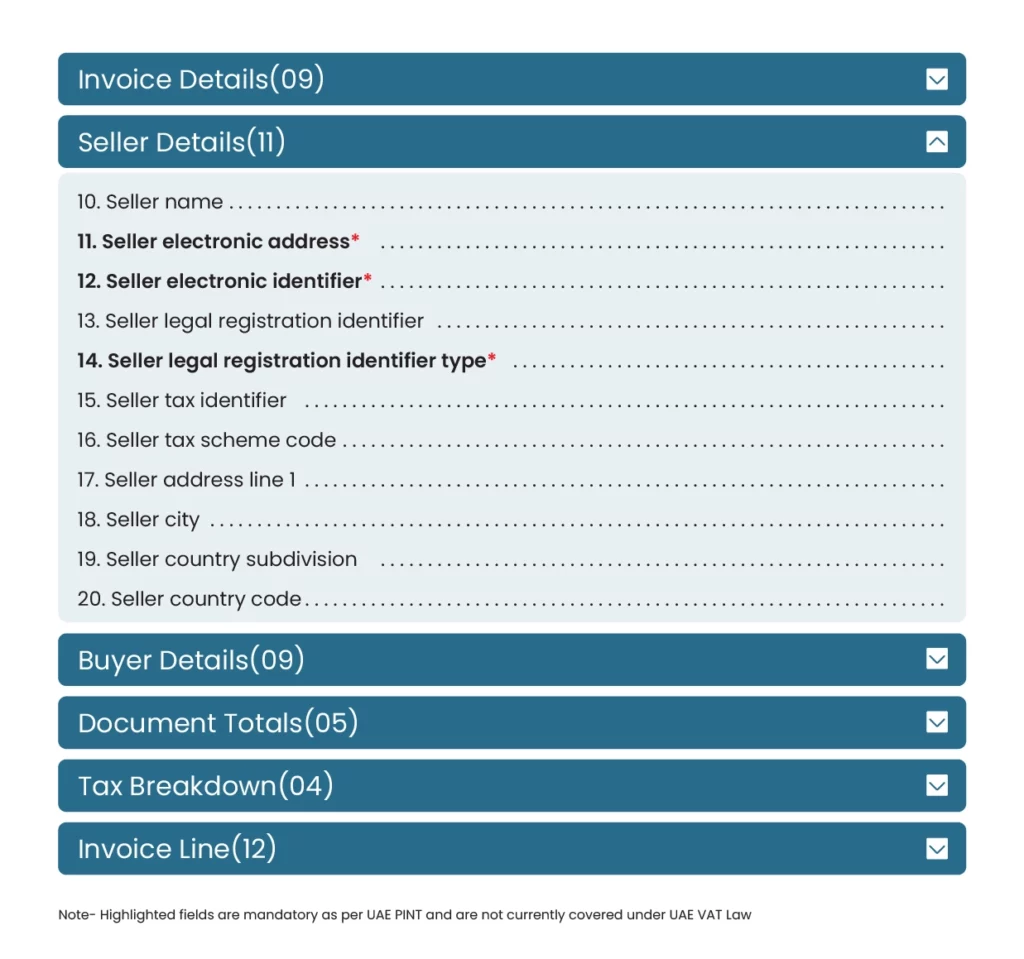

Seller Details

10. Seller Name (IBT-027)

The full legal name of the seller as registered in the national registry or as a taxable entity.

11. Seller Electronic Address (IBT-034)

The seller’s electronic address for invoice delivery. It must include a scheme identifier (e.g., CEF EAS code list).

12. Scheme identifier

The scheme identifier shall be chosen from a list to be maintained by the Connecting Europe Facility.

13. Seller Legal Registration Identifier (IBT-030)

An official identifier for the seller as a legal entity. It must occur at most once and follow specific formatting rules depending on the scheme.

14. Seller Legal Registration Identifier Type

To identify the nature of commercial registration number issued in UAE.

15. Seller Tax Identifier (IBT-031)

The seller’s tax identification number (TRN). It must be 15 alphanumeric digits, starting with 1 and ending with 03.

16. Seller Tax Scheme Code (IBT-031-1)

The scheme of the tax identifier. Default Value of VAT to be used. Must be coded using one of the ISO 6523 ICD list.

17. Seller Address Line (IBT-035)

The main address line of the seller’s postal address. Mandatory and part of the seller’s postal address.

18. Seller City

The city, town, or village where the seller is located. Mandatory and part of the seller’s postal address.

19. Seller Country Subdivision (IBT-039)

The region, state, or province of the seller’s address. For UAE, it must be one of the emirates (e.g., DXB, AUH).

20. Seller Country Code

A code identifying the seller’s country, using ISO 3166-1.

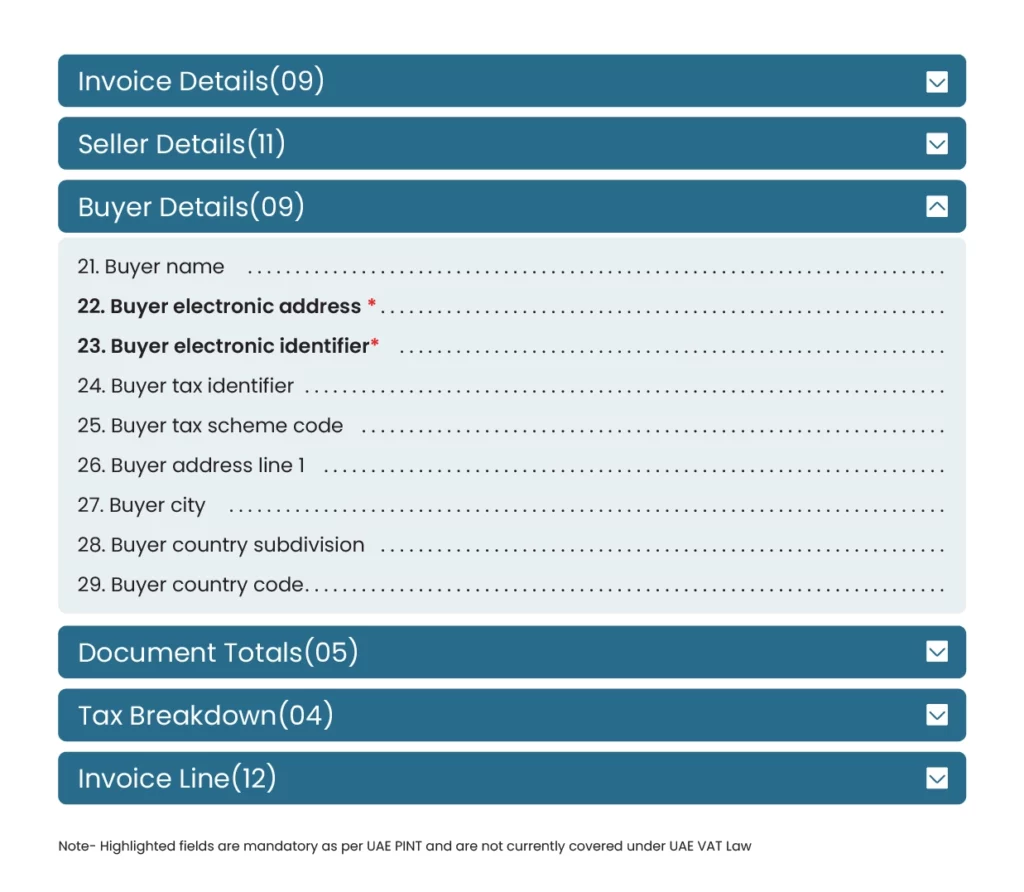

Buyer Details

21. Buyer Name (IBT-044)

The full name of the buyer. Mandatory and must occur at most once.

22. Buyer Electronic Address (IBT-049)

The buyer’s electronic address for invoice delivery. Must include a scheme identifier (e.g., CEF EAS code list).

23. Scheme identifier (IBT-049-1)

The scheme identifier shall be chosen from a list to be maintained by the Connecting Europe Facility.

24. Buyer Tax Identifier (IBT-048)

The buyer’s tax identification number (e.g., TRN). Must be 15 alphanumeric digits, starting with 1 and ending with 03.

25. Buyer Tax Scheme Code

The scheme of the tax identifier. Default Value of VAT to be used.

26. Buyer Address Line (IBT-050)

The main address line of the buyer’s postal address. Mandatory and part of the buyer’s postal address.

27. Buyer City (IBT-052)

The city, town, or village where the buyer is located. Mandatory and part of the buyer’s postal address.

28. Buyer Country Subdivision (IBT-054)

The region, state, or province of the buyer’s address. For UAE, it must be one of the emirates (e.g., SHJ, RAK).

29. Buyer Country Code (IBT-055)

A code identifying the buyer’s country, using ISO 3166-1.

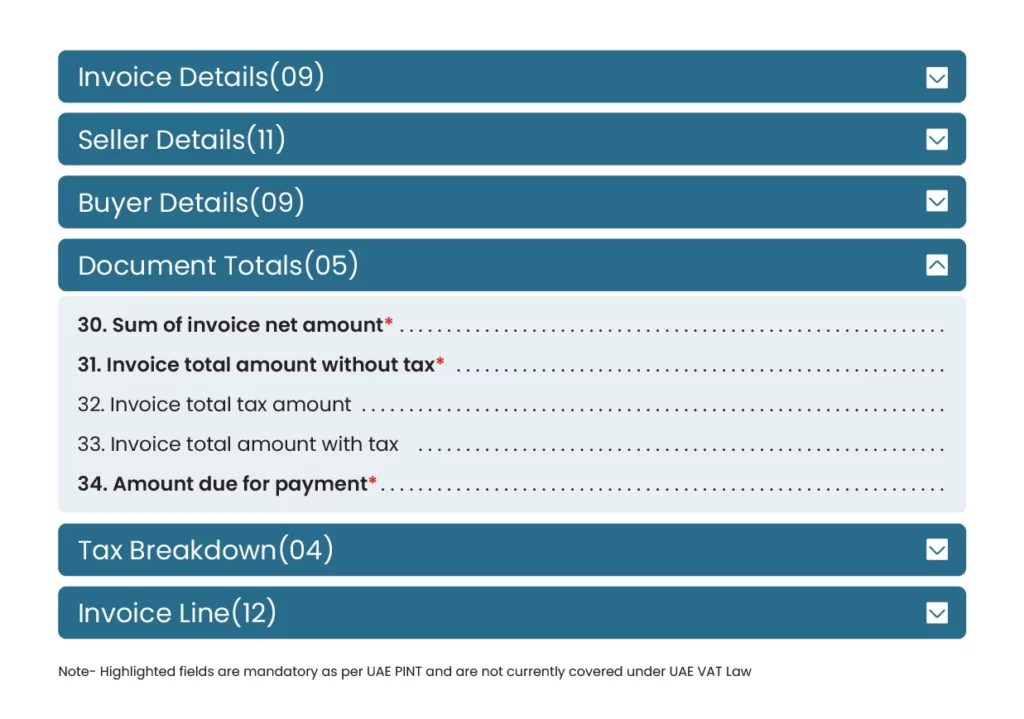

Document Totals

30. Sum of Invoice Net Amount (IBT-106)

The total of all invoice line net amounts before tax. Mandatory and must match the sum of individual line amounts.

31. Invoice Total Amount Without Tax (IBT-109)

The total invoice amount excluding tax. Must have no more than 2 decimals.

32. Invoice Total Tax Amount (IBT-110)

The total tax amount for the invoice. Must equal the sum of tax category amounts and have no more than 2 decimals.

33. Invoice Total Amount with Tax (IBT-112)

The total invoice amount including tax. Must equal the sum of the net amount and total tax amount.

34. Amount Due for Payment (IBT-115)

The outstanding amount requested for payment. Must account for paid amounts and rounding adjustments.

Tax Breakdown

35. Tax Category Taxable Amount (IBT-116)

The sum of taxable amounts subject to a specific tax category. Must align with the applicable tax rate.

36. Tax Category Tax Amount (IBT-117)

The total tax amount for a given tax category. In tax category code (IBT-118) is “Standard Rate”, Tax category tax amount (IBT-117) shall equal to Tax category taxable amount (IBT-116) multiplied by the Tax category rate (IBT-119) / 100

37. Tax Category Code (IBT-118)

A code identifying the tax category (e.g., “Standard Rate”). Must align with the invoiced item tax category.

38. Tax Category Rate (IBT-119)

The tax rate percentage for a specific category.

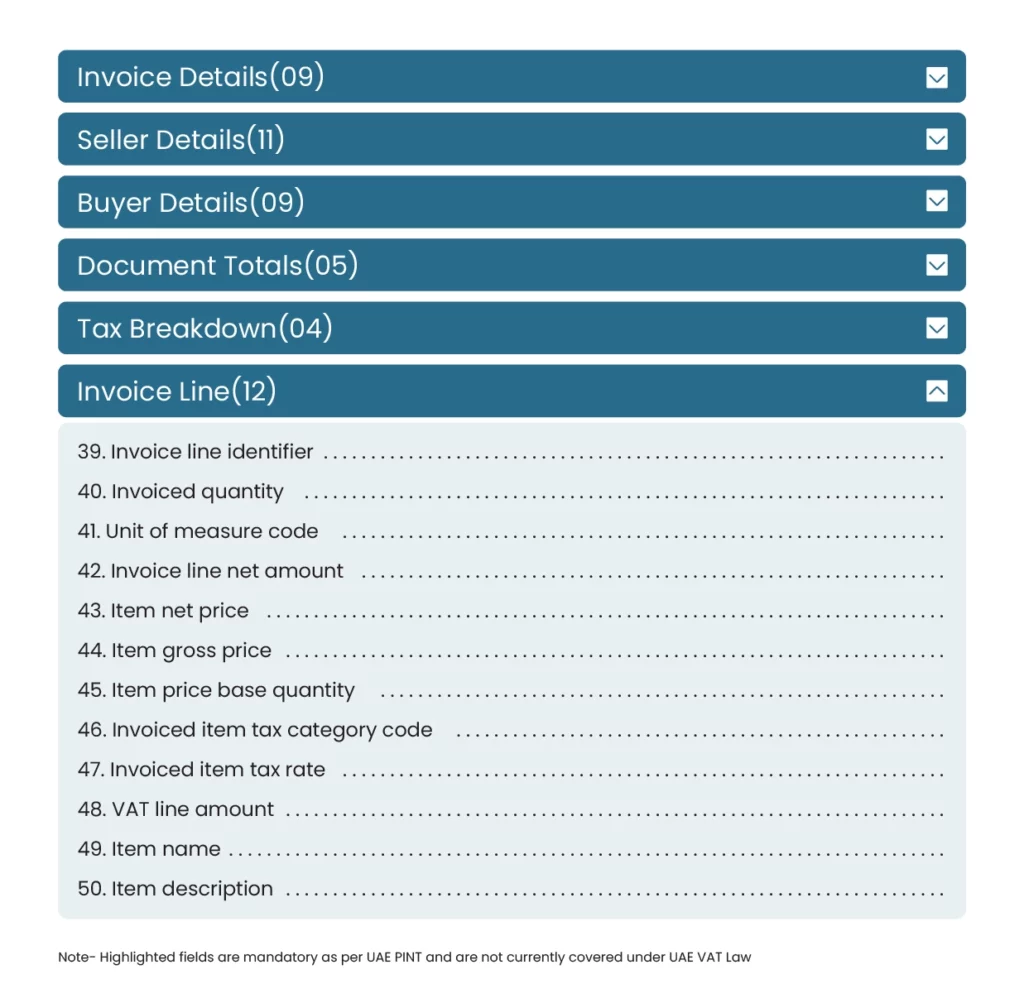

Invoice Line

39. Invoice Line Identifier (IBT-126)

A unique identifier for each invoice line. Mandatory for all lines.

40. Invoiced Quantity (IBT-129)

The quantity of goods or services charged in the invoice line.

41. Unit of Measure Code (IBT-130)

The unit of measure for the invoiced quantity. Must use UN/ECE Recommendation 20 codes.

42. Invoice Line Net Amount (IBT-131)

The total amount of the invoice line before tax. Must equal the invoiced quantity multiplied by the net price.

43. Item Net Price (IBT-146)

The unit price after discounts, excluding tax. Must equal the gross price minus any discounts.

44. Item Gross Price (IBT-148)

The unit price before discounts and tax. Must not be negative.

45. Item Price Base Quantity (IBT-149)

The number of item units to which the price applies. Must be a positive number above zero.

46. Invoiced Item Tax Category Code (IBT-151)

The tax category code for the invoiced item (e.g., “Standard Rate”). Must align with the tax breakdown.

47. Invoiced Item Tax Rate (IBT-152)

The tax rate percentage for the invoiced item. Must not be zero for standard rates.

48. VAT Line Amount (BT UAE-08)

The tax amount for each line item. For standard rates, it equals the net amount multiplied by the tax rate.

49. Item Name (IBT-153)

The name of the invoiced item. Mandatory for all invoice lines.

50. Item Description (IBT-154)

A description of the invoiced item. Mandatory and must occur at most once per line.

Bridging the Gap: Traditional VAT Invoice vs. Structured e-Invoice in the UAE

Tax Invoice (Current)

E-Invoice

Format

PDF/paper accepted

Structured (XML/UBL)

Mandatory Fields

- Supplier’s name, address, and TRN (Tax Registration Number).

- Buyer’s name, address, and TRN (if registered).

- Invoice number and issue date.

- The date of supply if different from the date the Tax Invoice was issued

- Description of goods/services.

- For each Good or Service, the unit price, the quantity or volume supplied, the rate of Tax and the amount payable expressed in AED

- The amount of any discount offered

- The gross amount payable expressed in AED.

- The Tax amount charged under the provisions of the Decree-Law expressed in AED, together with the rate of exchange applied where the currency is converted from a currency other than the UAE dirham

- Where the invoice relates to a supply under which the Recipient of Goods or Recipient of Services is required to account for Tax, a statement that the Recipient is required to account for Tax, and a reference to the relevant provision of the Decree-Law

Structured (XML/UBL)

Real-Time Reporting

No

Yes