The introduction of Value Added Tax (VAT) in the UAE on January 1, 2018, represented a significant shift in the country’s taxation framework. The real estate sector, a key contributor to the UAE’s economy, was directly impacted by this change. VAT, at 5%, applies to goods and services, including real estate. However, the VAT treatment of real estate transactions in the UAE is distinct, with specific rules that depend on the type of property involved and the nature of the transaction.

VAT Applicability on Real Estate Supplies in the UAE

In the UAE, the VAT treatment of real estate is categorized into two main types: commercial and residential properties. The VAT liability differs significantly depending on whether the transaction involves the supply of residential or commercial real estate.

1. Residential Properties

The supply of residential properties is typically exempt from VAT under UAE tax laws. This exemption applies to:

- The sale or lease of residential properties (houses, apartments, villas).

- The granting of long-term leases for residential purposes.

This exemption aims to make residential properties more affordable and accessible for individuals and families. However, it is important to note that while the sale of residential properties is exempt from VAT, developers and property owners may still incur VAT on expenses related to the development, construction, and maintenance of residential properties. These VAT costs may be recoverable if the property is subsequently used for taxable supplies.

2. Zero-Rating of Residential Properties

In addition to the exemption, there are specific circumstances in which residential properties are subject to zero-rated VAT. Zero-rating means that VAT is charged at 0%, and the seller or developer can recover VAT incurred on related costs.

- First Supply of a Newly Constructed Residential Property: The first sale of a newly constructed residential property is subject to zero-rated VAT but it must be made within 3 years of the building’s completion date. This allows developers to recover VAT on construction and development costs, which can reduce the overall cost of building new homes.

- Leasing of New Residential Properties: The leasing of newly built residential properties (those never leased before) can be zero-rated, provided the lease is long-term (more than six months). Short-term leases of residential properties remain exempt from VAT.

Exception of Zero rating the export of services

According to Article 31 of the VAT Public Clarification on Amendments to the Executive Regulation of Federal Decree-Law No. 8 of 2017 on Value Added Tax – Cabinet Decision No. 100 of 2024 (VATP040), services directly related to real estate located in the UAE that are supplied to a non-resident do not qualify for the zero-rated export of services.

3. Commercial Properties

Unlike residential properties, the supply of commercial real estate is subject to VAT at the standard rate of 5%. This includes:

- The sale or lease of office buildings, retail spaces, and industrial properties.

- The supply of vacant land intended for commercial use.

Commercial property transactions, including both the sale and leasing of such properties, attract VAT at the standard rate 5%, and the buyer or tenant is required to pay VAT on the transaction. Businesses that engage in such transactions can recover VAT paid on expenses incurred during the purchase, construction, or development of these properties, provided they are using the property for taxable business purposes.

4. Mixed-Use Properties

Properties that are used for both residential and commercial purposes, such as mixed-use developments, present a more complex VAT treatment. The VAT liability depends on the proportion of the property’s use that is residential versus commercial. The commercial portion will generally be subject to VAT 5%, while the residential portion will be exempt. Developers and property owners must carefully assess and allocate the VAT treatment based on the intended use of each part of the property.

Place of Supply of Real Estate

For real estate-related services, the place of supply is where the property is located. This includes services such as construction, leasing, and maintenance. If the property is in the UAE, the supply is considered made within the UAE, and UAE VAT applies (subject to the usual rules).

Additional Key Points from the UAE VAT Real Estate Guide

To ensure comprehensive compliance, real estate professionals must also consider the following nuanced areas from the UAE VAT Real Estate Guide:

1. VAT on Property-Related Services

In addition to the sale and lease of properties, the VAT Real Estate Guide also covers property-related services that may be subject to VAT:

- Property Management Services: Services such as maintenance, cleaning, and security for properties, which are subject to VAT at the standard rate of 5%. However, for residential properties where the lease is exempt, related services may still attract VAT.

- Real Estate Agency Fees: Commissions and fees charged by real estate agents or brokers for selling or renting properties are subject to VAT at 5%.

- Ancillary Services: Additional services that are provided in connection with the supply of real estate, such as leasing services, parking, and utilities, may also be subject to VAT 5% depending on the nature of the service and the type of property.

2. Sale of Land

Sale of land is generally exempt from VAT unless the land is being developed or used for a commercial purpose. The VAT treatment on land sales depends on whether the land is sold for development or commercial use.

- Sale of Vacant Land: The sale of vacant land is typically exempt from VAT, but VAT may apply if the land is being used for taxable supplies or is part of a commercial development.

- Development of Land: If a developer constructs or improves property on the land, the resulting sale of the developed property (whether residential or commercial) may be subject to VAT 5%. The VAT Real Estate Guide encourages developers to assess the VAT implications of land sales carefully, particularly in relation to the potential for future taxable developments.

3. Mixed-Use Developments

For mixed-use developments (e.g., developments with both residential and commercial spaces), the VAT treatment depends on the use of the property. The residential portion is generally exempt from VAT, but the commercial portion is subject to VAT at the standard rate of 5%.

- Proportional Allocation: Developers and owners must properly allocate VAT treatment between the residential and commercial parts of the development. The VAT Real Estate Guide emphasizes the importance of maintaining accurate records and ensuring the correct allocation for VAT purposes. The treatment of common areas in mixed-use developments should also be assessed to determine if VAT applies to services or common property.

Conclusion

In summary, the VAT liability for real estate in the UAE varies based on the type of property and the nature of the transaction:

- Residential properties: Typically exempt from VAT, but subject to zero-rated VAT for the first sale of new homes and leases of new residential properties.

- Commercial properties: Subject to VAT at 5% for both sales and leases.

- Mixed-use properties: VAT applies to the commercial portion of the property; the residential portion is exempt.

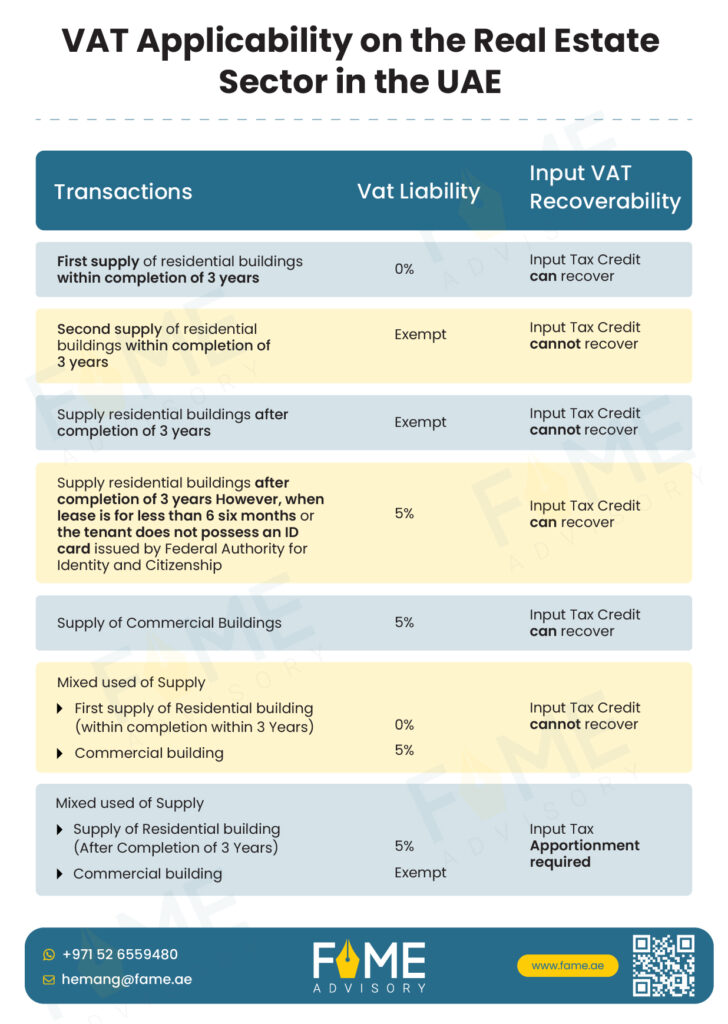

Transactions | VAT Liability | Input VAT Recoverability |

|---|---|---|

First supply of residential buildings within completion of 3 years | 0% | Input Tax Credit can recover |

Second supply of residential buildings within completion of 3 years | Exempt | Input Tax Credit cannot recover |

Supply residential buildings after completion of 3 years | Exempt | Input Tax Credit cannot recover |

Supply residential buildings after completion of 3 years However, when lease is for less than 6 six months or the tenant does not possess an ID card issued by Federal Authority for Identity and Citizenship | 5% | Input Tax Credit can recover |

Supply of Commercial Buildings | 5% | Input Tax Credit can recover |

Mixed used of Supply

| Input Tax Credit can recover | |

1. First supply of Residential building

(within completion within 3 Years)

| 0% | |

2. Commercial building | 5% | |

Mixed used of Supply | Input Tax Apportionment required | |

1. Supply of Residential building

(After Completion of 3 Years) | Exempt | |

2. Commercial building | 5% |

These guidelines ensure that the real estate sector operates within the VAT framework while balancing the need for affordable housing with the commercial viability of development projects. Real estate professionals must remain mindful of the specific VAT treatments applicable to their transactions to ensure compliance with UAE tax laws.

Understanding these provisions, as outlined in the UAE VAT Real Estate Guide, is crucial for developers, investors, and property owners navigating the real estate market in the UAE.